Verify availability of seats on the selected date and confirm the transaction. Provide details about the start and end points of your journey, date of journey and number of tickets. To book bus tickets to destinations in Karnataka, log on to the KSRTC website.

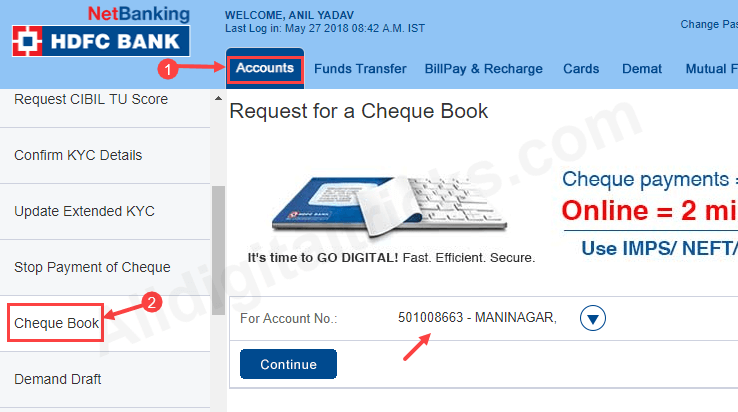

NEW CHEQUEBOOK UPDATE

Once a transaction is processed, an appropriate response will be sent to airlines site to update the status of the transaction. The request may be processed based on values sent from the airlines website. The payment request will be redirected to Internet Banking site. Logon to Indian Airlines website to make a payment for an e-ticket through State Bank of India, you need to select SBI as the payment option. You can also book your Air ticket through the e-ticketing feature. For cancellation of i-ticket, you shall be required to submit your ticket at a computerized counter of Railways and on cancellation, the amount shall be credited back to your account. Cancellation of E-ticket can be done by logging on to IRCTC's site refund amount will be credited to your account directly within 2-3 days. 10/- per transaction shall be levied in addition to the cost of the ticket. E-ticket can be printed by you whereas the i-ticket will be dispatched by IRCTC at the given address. After a successful debit, Railways will generate the ticket. After submitting the respective ID and password, you can select your account.

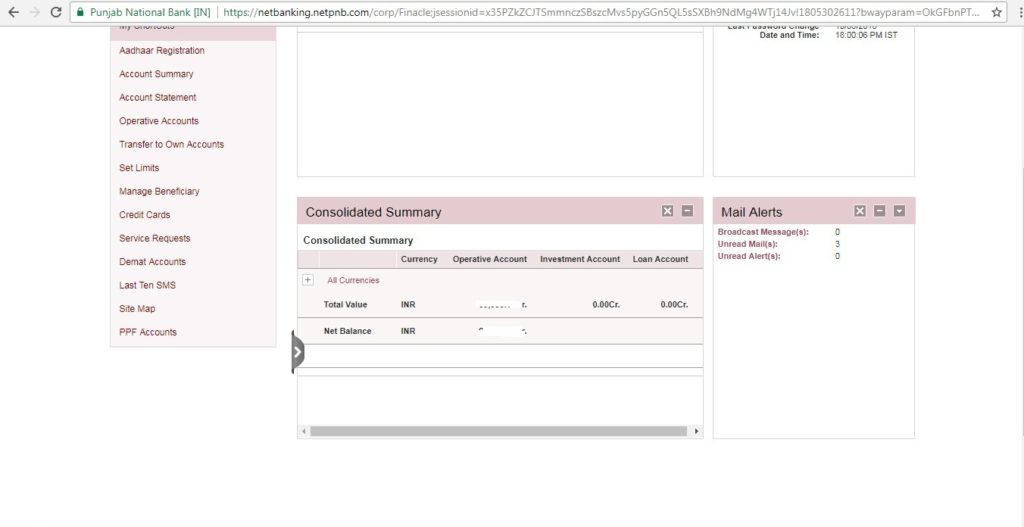

You will be redirected to Internet Banking site of SBI ( ). For an e-ticket, the details of photo identity card will required to be filled in)Īnd select State Bank of India in the payment options.

READ: CBN grants approval for banks to debit accounts of loan defaulters What you should know 1 to Apis due to outbreak of the Covid-19 pandemic and the impact it had on the Nigeria Cheque Standard (NCS) and Nigeria Cheque Printers Accreditation Scheme (NICPAS) Version.

NEW CHEQUEBOOK FULL

The extension of full implementation date from Jan.All deposit money banks are (therefore) directed to actively enlighten their customers and ensure necessary provisions are put in place for a smooth migration to the New standard.Sanction grid will be fully operational on April 1, 2021. Full enforcement of the second edition of the Nigeria Cheque Standard (NCS) and Nigeria Cheque Printers Accreditation Scheme (NICPAS) Version 2.0 will commence Apand the NCS/NICPAS 2.0.The parallel run, in which old and new cheques are allowed to co-exist, will end on 31st March 2021, and thus only new cheques would be allowed in the clearing system from 1st April 2021.

Consequently, it has become imperative for the CBN to issue the following clarifications It has come to our notice that some stakeholders interpret the circular differently from the intended purpose.

0 kommentar(er)

0 kommentar(er)